-

在线咨询

-

考试动态

考试指南

考经分享

考试资讯

常见问题

CFA机考会提供草稿纸吗?(附CFA考场规则)

从小习惯纸笔考试的小伙伴在看到CFA是采用机考之后,会有很多疑问,比如:CFA机考会提供草稿纸吗?下面就来为大家详细介绍CFA考场规则。

CFA证书有有效期吗?

CFA三个级别出题的原则是什么?

CFA考试成绩被取消该怎么处理申诉?

这些专业更适合报名参加CFA考试!

2024年CFA考生注意!CFA考试将迎来六大变革!

CFA官方教材和NOTES有什么区别?

CFA二级考试大学生也能报名!(附CFA机考报名条件)

CFA会员与CFA持证人有什么区别?

CFA考试成绩有有效期吗?有效期多久?

金融零基础该如何备考CFA考试?

更多>>

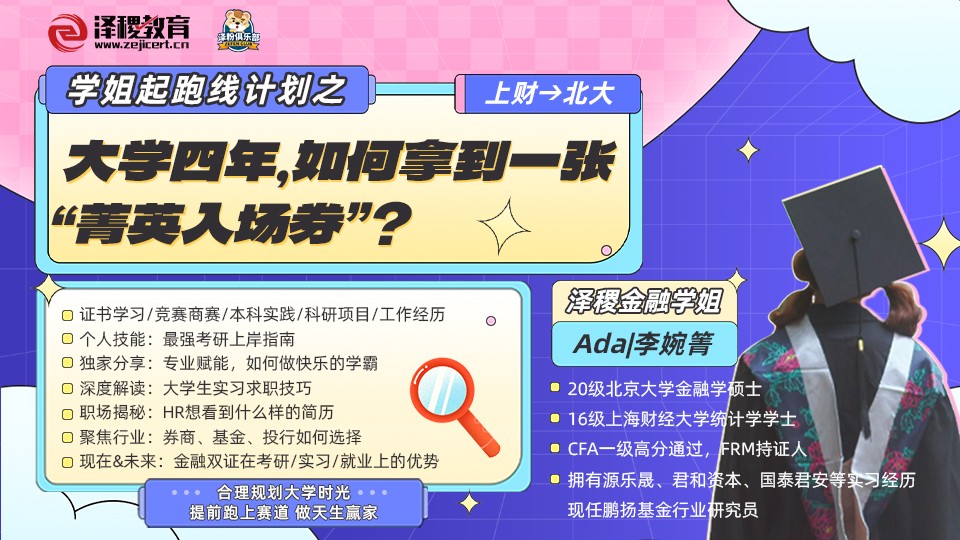

CFA报名条件新消息:大学在校生能报CFA二级了!

根据CFA协会的最新公告,协会在CFA一级最早可以在本科毕业月份前23个月(含)以内报考的基础上,增加了即可在本科毕业前11个月内报考CFA二级的条例,也就是在大学期间,最快可以同时拿下CFA一级、二级了!

备考CFA需要看几遍教材比较合适?

考过CFA一级有用吗?CFA一级有什么价值?

在职边工作边备考CFA该如何规划时间?

CFA三个级别考试的难度如何?出题有什么规律吗?

备考CFA如何提高英语水平?

这些原因导致你无法通过CFA考试

考过了CFA一级意味着什么?

CFA一级考试如何备考?

CFA考试道德模块备考攻略

CFA各级别考试分值占比及备考攻略

更多>>

CFA证书是金融行业入场券吗?

不少小伙伴报名参加CFA考试是想藉由这个证书进入到金融行业,那么CFA证书是金融行业入场券吗?下面就来带大家详细了解。

考过CFA一级和三级有什么区别?差别有多大?

CFA官方:11月CFA考试出分时间公布!

CFA持证人就业方向有哪些?

考出CFA证书之后可以去哪些高薪岗位?

CFA考试一定要通过三个级别才有用吗?

CFA三个级别考出后职业方向如何?

CFA证书到底是不是金融行业必备的敲门砖?

金融圈四大证书,CFA排名靠前!

成功获得CFA证书后,可以从事哪些工作?

CFA证书都是哪些人在报考?

更多>>

什么样的人比较适合报名参加CFA考试?

CFA作为金融领域含金量非常高的证书,每年都有大量考生报名参加考试,不过有的小伙伴就要问了:我适合报考CFA吗?下面就来为大家介绍什么样的人比较适合报名参加CFA考试。

CFA缺考会影响后续考试报名吗?CFA缺考弃考有什么后果?

CFA考试缺考会影响下一次报考吗?

2023年2月CFA®考试报名信息公布!

CFA®证书申请条件是什么?考下来要多少钱?

CFA®考试地点有哪些?该如何选择?

CFA®如何报名步骤是什么?

CFA®和FRM哪个含金量高?哪个好考一点?

协会官宣5月CFA®考试提供免费延期!附CFA®考试延期申请方式

CFA®考试能延期吗?如何申请?

CFA®考试需要护照吗?考下来要多少钱?

更多>>

白金级认可培训资质(总部)

白金级认可培训资质(总部)

课程试听

课程试听

职业规划

职业规划

ACCA中文教材

ACCA中文教材

考位预约

考位预约

免费资料

免费资料

题库下载

题库下载

模拟机考

模拟机考

CFA®成绩查询

CFA®成绩查询

GARP协会官方认可FRM®备考机构

GARP协会官方认可FRM®备考机构